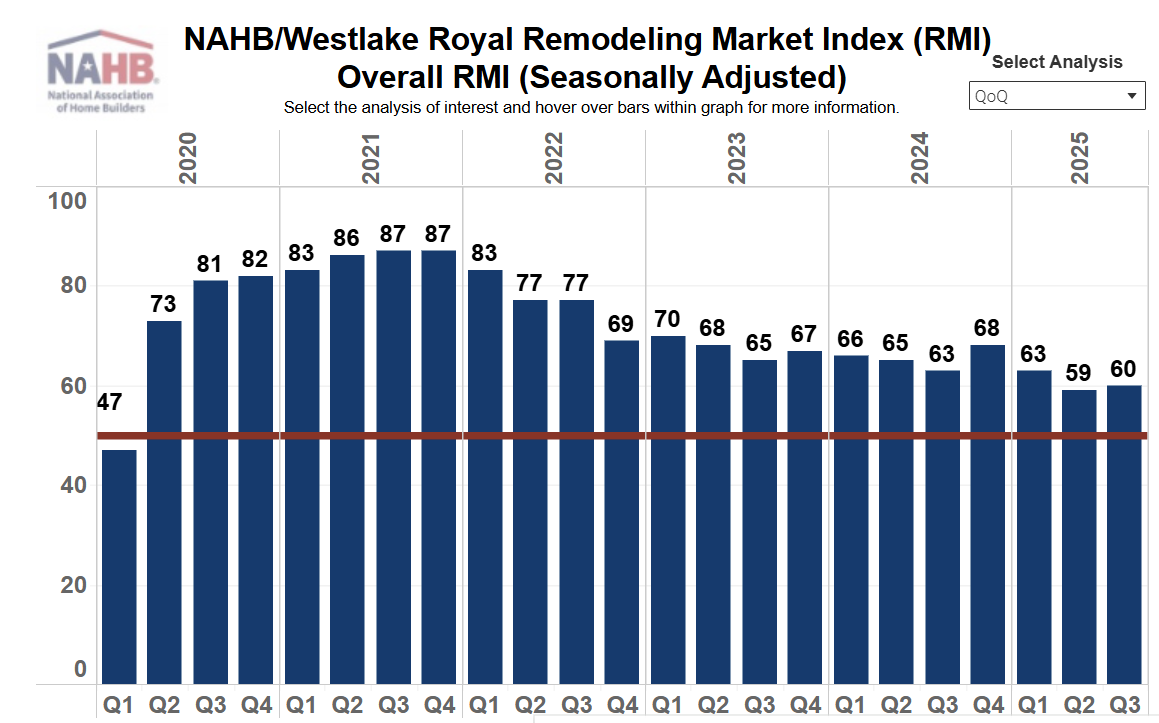

In the third quarter of 2025, the NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 60, up one point compared to the previous quarter. With the reading of 60, the RMI remains solidly in positive territory above 50, but lower than it had been at any time from 2021 through 2024.

Overall, remodelers remain optimistic about the market, although slightly less optimistic than they were at this time last year. The most significant headwinds they are facing include high material and labor costs, as well as economic and political uncertainty making some of their potential customers cautious about moving forward with remodeling projects.

The small quarter-over-quarter improvement in the RMI is consistent with flat construction spending trends and the current wait-and-see demand environment. Going forward, remodeling spending should continue to grow, supported by the aging housing stock and gains for household net worth.

The RMI is based on a survey that asks remodelers to rate various aspects of the residential remodeling market “good”, “fair” or “poor.” Responses from each question are converted to an index that lies on a scale from 0 to 100. An index number above 50 indicates a higher proportion of respondents view conditions as good rather than poor.

Current Conditions

The Remodeling Market Index (RMI) is an average of two major component indices: the Current Conditions Index and the Future Indicators Index. The Current Conditions Index is an average of three subcomponents: the current market for large remodeling projects ($50,000 or more), moderately sized projects ($20,000 to $49,999), and small projects (under $20,000). In the third quarter of 2025, the Current Conditions Index averaged 68, up two points from the previous quarter. All three components increased quarter-over-quarter and remained above the break-even point of 50. Moderately-sized projects rose four points to 70, large projects were up two points to 64, and small remodeling projects inched up one point to 71.

Future Indicators

The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in, and the current backlog of remodeling projects.

In the third quarter of 2025, the Future Indicators Index averaged 52, increasing one point from the previous quarter. The component measuring the backlog of remodeling jobs also increased, rising four points to 56. The component measuring the current rate at which leads and inquiries are coming in, however, decreased two points from the previous quarter, falling into negative territory at 49.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link